giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

+1 and great post! :) Gio

-

;D ;D ;D Gio

-

Ah! Well, of course I didn’t mention that I started some years ago a company with a capital of 1 million euros. Grew it at an 18% CAGR until now, and have the goal to keep making it grow, until its capital gets to be 1 billion euros. My idea basically is to achieve a 15% CAGR for the next 45 years. Though I am almost surely bound to fail, you can easily understand that “early retirement” is not an option I have even contemplated! ;D ;D ;D Gio

-

For 30 years?! Hey! I am very well aware of the fact that there’s “randomness”, but I also believe in “process”, and “discipline”, and “focus”. I look for someone “focused” on the right “process” (at least a process I can understand and agree with), and who shows the “discipline” to follow it. If I can find 10 to 15 people like that… I guess I might even succeed in coping with “randomness” fairly well! ;) Gio

-

Phcap, I am 12 years older than you… and since I started working, I don’t remember a single day in which I woke up thinking that I had to do something I didn’t like… I am serious! Not one day that I can remember! I have always concentrated on what I like the best and then seized the good opportunities that naturally presented themselves to me. If those opportunities entailed doing something I was not passionate about, I have always let them go… no matter how much rewarding they might have been in the future. Of course, I am no particular success at all, and therefore I don’t see why you should heed my advice. But I can tell you I am happy. Cheers and all the best for your future career, whatever your final choice will be! :) Gio

-

Well, I am not really worried about the reinsurance side of the business: Mr. Berger has a wonderful track-record, and it went through many catastrophic events without being tarnished a bit! Of course, as I have just pointed out, bad luck might always happen… On the investment side, instead, I am a bit more worried… Though Mr. Loeb has a wonderful track record, he did poorly in 2008 and he is way too aggressive now for my tastes… That’s basically why TPRE is a very small position in my firm’s portfolio right now. Yet, once again, I like what I see. :) Gio

-

Well, you just cannot do business that way. At least, I don’t see how… When you do business, you want to concentrate on ideas, review them carefully and thoroughly, and then, when you have finally made up your mind they have some merits, to proceed implementing them, committing as few mistakes as you can. That's all you can really do... And that’s imo what Mr. Loeb is doing. Therefore, I like what I see… even if I cannot exclude bad luck from happening! Trading, maybe, could be different… I don’t know… I don’t trade… A good trader might be successful in controlling even bad luck… But I don’t see how a good entrepreneur could. If you are looking for something that is "bad luck shielded", just forget about running a business! ;) Gio

-

Well, I know a lot of engineering firms which have failed, yet I don’t necessarily think mine is bound to repeat their results… Success and failure are always just the natural outcomes that proceed from very real and tangible, if not always self-evident, reasons. I know exactly WHY those engineering companies have failed, and I know mine is not repeating those same mistakes. And this give me confidence we won’t follow in their steps. Similarly, it would be reasonable to worry about TPRE, only if you know exactly why Montpelier Re failed, and you see TPRE is making the same mistakes. For what I know (and unfortunately I know very little about Montpelier Re!), Mr. Loeb is not involved in the reinsurance operations. Instead, he manages the investments part of the business (with a track-record of 21% net annualized since 1995). For the reinsurance operations, instead, he has chosen (wisely imo) Mr. Berger, who has an excellent track-record over more than 30 years. What you have here is the combination of a “master investment professional” with a “master reinsurance professional”. If you lack any more specific details about what they are doing and why they are supposedly following in Montpelier Re's steps, replicating Montpelier Re's errors, chances are very much in favor of the fact Mr. Loeb and Mr. Berger will keep on replicating their past track-records, instead of Montpelier Re’s. Gio

-

--John D. Rockefeller, Sr. Gio

-

You are very welcomed, Dazel! And I agree with you! :) Gio

-

+1 Always can count on those two for great and useful information! :) Gio

-

Actually, when you start a new reinsurance company, you have kick off costs that afterwards should disappear… at least in theory! And it takes some time to grow premiums relative to general and administrative costs (which tend to be almost fixed). Therefore, I think the 107% combined ratio still might be negatively affected by those two facts. But it is clearly improving: from 127% in 2012 to 107% in 2013. Let’s hope they keep lowering it! :) Gio

-

Yes! I think they are. In fact, the monthly report on investments you can download from the TPOU’s internet site and the one downloadable from the TPRE’s internet site are exactly the same, aren’t they? Gio

-

How has Exxon outperformed competitors for so long?

giofranchi replied to LongHaul's topic in General Discussion

My answer is always the same… SUPERIOR CAPITAL ALLOCATION I know, I am extremely boring… ;) Gio -

Investor Presentation November 2013 Gio TPRE_-_Investor_Presentation_November_2013.pdf

-

--Carl Icahn http://www.shareholderssquaretable.com/personal_views/ Gio

-

I have read Mr. Kahneman, Mr. Klein, Mr. Thaler, Mr. Ariely, Mr. Burnham, Mrs. Dweck, Mr. Csikszentmihalyi, and others… And I liked them very much, and I think their work is great and very helpful! Yet, to overestimate their importance would be as much an error as to overlook them… 1) Allocation of capital (or resources in general) is the single most important thing in business, 2) There is a sound way to allocate capital (or resources in general), based on the priciples of value investing, 3) As in almost any other human endeavor, there are masters at allocating capital. Gio

-

Fairfax agrees to acquire majority stake in The Keg

giofranchi replied to ourkid8's topic in Fairfax Financial

Prem, recently Kraven has given me some dating advices that worked out just wonderfully!! Maybe, after all, you should pay attention to what he is saying!! ;D ;D ;D Gio -

Wall of worry. Difficult… Wall of worry usually is about the economy… That would make sense to me… Not prices! If everyone thinks prices are extremely high, who is buying?! Would you buy, because you worry that prices are high?! I don’t understand… Gio If everyone thinks prices are high and is thus underinvested, by definition that creates buying power. Conversely.... If everyone thinks "this time is different" and is thus fully invested, by definition all of the buying power is used up. Ok, this might be true. Anyway, take a look at the poll: 36 to 38… It is clear enough to me that we just don’t know… So, make sure you are going to make money both if the market keeps advancing and if the market suffers a steep correction! ;) Gio

-

I agree 100%. And great quote! :) Gio

-

Wall of worry. Difficult… Wall of worry usually is about the economy… That would make sense to me… Not prices! If everyone thinks prices are extremely high, who is buying?! Would you buy, because you worry that prices are high?! I don’t understand… Gio

-

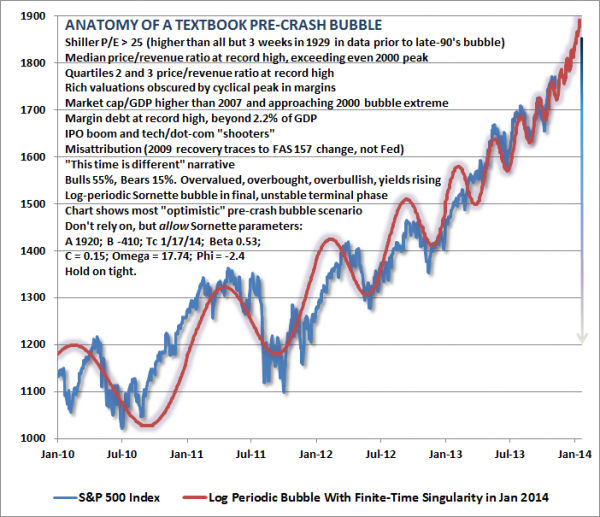

This makes little sense to me: if everyone think we are in a bubble, why do the markets keep going up? The answer might be: we might know we are in a danger zone, yet the Fed is yelling: “you must dance, until the music stops!!”. And we cannot but heed the call… Crowd psychology can go just that far… If prices keep diverging from economic values, a bubble will form, either we are aware of it or not. Gio

-

Q3 2013 Conference Call Gio third-point-reinsurance-Q3-2013-conference-call.pdf

-

"Forget The Yield Curve, Watch The Wicksellian Spread" by Mr. Charles Gave Gio charles-gave-forget-the-yield-curve-watch-the-wicksellian-spread.pdf

-