JAllen

Member-

Posts

622 -

Joined

-

Last visited

About JAllen

- Birthday 02/19/1981

JAllen's Achievements

Newbie (1/14)

0

Reputation

-

Google "Horizon Kinetics owner operator" for the answer to your first question, and probably some more.

-

Definitely would like to meet up at some point too. Closer to the Bay Area would be better for me, but I will let people know if I can make it up to Shasta/Redding

-

The price for a primary product halved. Think if Coke or Burger Kind did that. The business would be worth a lot less. The price of the stock didn't move nearly as much as oil did last December, if I recall correctly.

-

Sorry, forgot the link reset from the original post above. Quipp was not the linked one, but was another one of Burry's you can find if you click his user name once you're logged in.

-

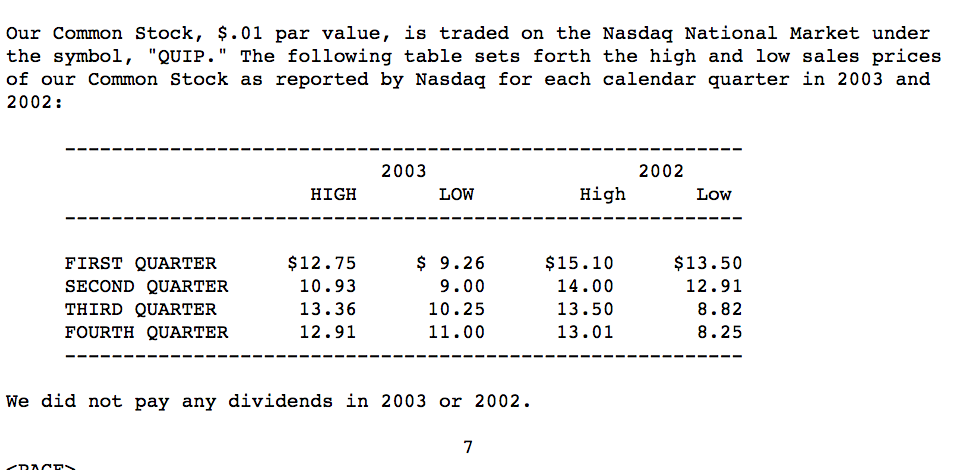

Interesting that Michael Burry's writeup about Quipp here performed quite poorly. See the subsequent market prices in the attached image from his $19 writeup price. Not criticizing, just pointing out that you can have a cheap stock that gets lots cheaper and predicting the future is super hard for everyone.

-

Why do you like this one more than GOV?

-

His investment strategy was basically how he wrote about in You Can Be A Stock Market Genius. Those were highlights from his OPM career. And yes, you can't find early Gotham Capital 13Fs. Why, I don't know. I have looked extensively; it makes no sense. Perhaps he requested them to be taken down or something. No idea. I believe the actual fund was called Gotham Capital, but there may have been another entity, similar to RBS partners for Eddie Lampert. I've written a couple of case studies about late 90s investments of his here: http://jallencapitalmanagement.com/writing.html Also, if I recall correctly Sears was at 5% of revenue with JCP at 50%, so not 1/5, but 1/10. Correction: 6% versus 56%, so 9.3x higher. That was the oft-hated relative valuation plus EV/revenues. Many investors don't approve of these approaches. I will, however, side with the investor with the best audited track record ever. One additional stock he owned at the tail end of his OPM career, since that is the period you asked about, is the one he was chairman of, Alliant.

-

I think the situation is a whole lot different than it was when the stock was ~$300

-

I'm saying that some of the language leaves it open that ESL and Fairholme can just exchange their rights, whatever the value of them is, for a lesser number of Seritage shares, instead of having to exercise their rights, which would involve investing more than $1b. The languages makes this possible, and I again point out the distinction between the word exchange and exercise. Does that make sense? This would be a natural way for them to retain a significant ownership stake without having to invest more cash and would help them stay under the REIT ownership limitations. And yes, I realize there is some language that says that ESL will own ~44% of the OP. But there is actually more language, stated multiple times, that they can exchange their rights instead of exercising them. Probably just a conspiracy theory of mine looking for ways owner-managers obfuscate value and enrich themselves. Wouldn't be the first time.

-

Just FYI to the board: I found out that the remaining fiber Windstream "owns" is not actually fee-owned, the fiber is primarily IRUs, or indefeasible rights of use, which is basically leased access to fiber. They wouldn't/didn't share much about duration or payment terms so there's not way to determine how much these IRUs are potentially worth. But I concluded they're not worth much...

-

I've attached what I'm calculating as the shares outstanding. Its my understanding that SRG will own 55.1% of the operating partnership (OP) and ESL will own 44.9% of the OP. The common shares outstanding will be 30.6, on a fully-diluted basis. The Class C (fairholme shares), non-voting will actually not show up as common shares unless they've converted, but I will assume that they'll be converted. Also, it would seem that Eddie's non-economic OP shares wouldn't really have value unless converted. Either way, the total fully-diluted share count should be 55.6 million. Not quite sure what to make of the 1.2 million non-economic shares that aren't reflected in the share count, but it wasn't substantial enough for me to dig further. I think you're right. I was thinking there was a chance that either or both ESL and Fairholme would exchange their rights for new Seritage shares, instead of exercising them and investing additional cash. If you look in the prospectus, there are quite a few occurrences of "exchange" as opposed to exercise. I was thinking they would do this because coming up with such an amount of cash is a non-trivial thing to do, even for ESL and Fairholme (although Fairholme did have a bunch of cash last quarter). Exchanging their rights would be a way for them to retain a substantial percentage ownership in the ongoing entity that would obviously have fewer shares outstanding - something like 32m or so instead. For an example of what I'm talking about, check out this paragraph: ESL has advised Seritage Growth that it intends to exchange a majority of its subscription rights for interests in a subsidiary of Seritage Growth and for Class B non-economic common shares of beneficial interest of Seritage Growth holding voting power in Seritage Growth, and FCM has advised Seritage Growth that it anticipates that certain Fairholme Clients, subject to the final terms of the offering and other considerations including market conditions and tax, regulatory and investment mandate restrictions, are likely to exchange a portion of their subscription rights for the Seritage Growth non-voting shares and that, subject to such considerations, certain other Fairholme Clients intend to exercise their subscription rights to purchase Seritage Growth common shares, in each case as more fully described in this prospectus. Notice how it says exchange a majority of its subscription rights for ESL but then uses exercise their subscription rights for Fairholme? I suppose this is because ESL is getting partnership units and not REIT common shares, but why not say exercise for ESL too in that first paragraph? Why not add the fact that ESL will both exchange or exercise PLUS invest the cash required? And also, the exchange agreements referenced in the prospectus that govern how ESL and Fairholme will get their Seritage securities were not filed. That just makes me suspicious.

-

Looking forward to your thoughts.

-

I was wondering if there was a way that there will end up being less than ~55m shares outstanding. Was thinking that the ESL and Fairholme exchange agreementshave could allow them to swap their rights for OP units, and that they would invest less cash than their 76m* $29.58 per share. There is quite a bit of language in the prospectus that suggests this could happen, and there is some that says this is not what is happening. So just a curiosity I have.

-

Has anyone spent a lot of time on the "exchange" language in the Seritage prospectus? The way the Fairholme and Lampert entities are getting their shares are stipulated by two exchange agreements, both of which weren't filed as exhibits, though the prospectus says they were.

-

I'm having a hard time wrapping my head around what's going on with WIN and wanted to post some thoughts and hopefully get feedback about how I’m wrong. So as you know, I've worked on WIN since January or so, and after the spin we sold both our CSAL and WIN positions, just because I was working on other things at the time and wanted to regroup/review. As a result, this post is not clouded by an existing position I’m trying to work my way out of or something like that. Now the spin has occurred, CSAL is trading at ~12.5x EBITDA, which is a bit more than I expected, and we have WIN, whose price has declined quite a bit. Especially post-results which seemed to indicate continued weakness but not an acceleration in that weakness. WIN's EV is something like $5.3 billion or so (the capital leases are liabilities but not debt in my eyes because there is no principal payment due at the end). WIN is going to generate approximately $1.25 billion of EBITDA this year, which assumes a lower than guided margin and a continued 3% revenue decline. It obviously deducts the CSAL payment as an expense, which I believe is the right way to look at it: don't count the lease liability as debt, but definitely deduct the payment as an expense, which is really what it is. So $5.3 billion EV and $1.25 billion of cash flow is about 4.25x. And as most of you know, this is quite a bit less than what other comparable telecoms, with a similar mix of business trade for, such as CTL. It's the cheapest I know of telecoms trading for, except for OTEL, but more about that later. Even LICT trades higher than this despite it being an illiquid OTC stock (though its overall revenue is slightly increasing). What really got me thinking is that WIN could be an attractive stock to own if you think it could trade to 5x or maybe 5.5x. This is because the equity is such a small part of the capital structure, about 16% right now. It wouldn't take much of a change in sentiment, slowing revenue declines, or a simple re-rating to 5x to cause a drastic change in the stock price. So I bought a few calls after drafting a similar post a few weeks ago. And then someone got in touch with me about WIN and CBB, actually. He reminded me that fiber businesses trade for 13-16x. I can't find a fiber or data center business that trades for less than 13x EBITDA. Obviously this range of multiples is quite a bit different than where WIN is trading (even if you call the capital lease debt) in total. Note that I’m not saying WIN as a whole should trade for anything like this. So I got to thinking, what if WIN has a valuable fiber/data center business hidden inside there with that nasty slightly declining legacy business. And it turns out, WIN does have a fiber business. WIN retained about 55,000 route miles of fiber and all of their data centers - all 27 of them - from the CSAL spin. I summed the square footage for the 18 DCs on WIN's website that disclose the square footage, which got me to 443,000 square feet of DC space that WIN owns. This excluded 9 data centers where they don’t list the square footage. If you assume the remaining 9 DCs have one-third the average space per DC, then WIN owns about 550,000+ square feet of data centers. I've got four data center comps that are purely DCs, and they trade for an average of $1,600 per foot, a minimum of $800/foot and an average of 6.4x revenue and a minimum of 5.7x revenue. The pure fiber comps I have trade for more than 5x revenue and well into double-digit EBITDA multiples. None trade cheaper than 13x EBITDA. WIN breaks down enterprise/SMB only - which totals $3 billion of revenue and doesn't break out how much is from fiber/DCs and how much is from providing legacy phone services to companies. You can deduce the amount of revenue that doesn’t come from “voice, long distance and miscellaneous revenues“ by doing some algebra on the disclosed growth rates of the entire enterprise and small business segment (see page F-7 in 2014 10-K [link at bottom of post]). Doing so gets you something like $1.5-$2 billion of this higher value revenue (closer to $2B but I'm trying to be conservative here). I should add that this portion of the enterprise/SMB segment grew at something like 25% in 2014 but appears to have flattened out in Q1. As a result, if you can't see it already, WIN's modern fiber/DC business could be worth almost as much as the current entire EV of the company, and if you were optimistic about it or thought it was worth what others trade for, it could be worth quite a bit more than the entire EV of the company. If you think WIN has anything like these kind of valuable assets, it also changes the debt situation as well. I believe WIN could readily sell a subset of these assets to a number of players, it seems, making what I believe is already a "manageable" debt situation more like a "totally fine" debt situation. I mentioned that WIN is priced cheaper than all other U.S. telecoms - but there's at least one exception, and that's OTEL. OTEL, I believe is down around 4x. Unfortunately OTEL is declining more rapidly than WIN and it has zero or almost zero modern revenue at all. OTEL was late in realizing that telecom as a whole needed to transition. WIN was making billion dollar fiber/data center acquisitions back in 2011, like Paetec. OTEL acquired a small managed hosting business last year, but if I recall correctly, it had less than $1 million of revenue and is about 1% of OTEL’s revenue still. So OTEL justifiably trades at a cheaper valuation. I should mention that OTEL has a massive maturity in one year or so and probably has zero secured debt capacity. WIN has no immediate maturities and has at least some secured debt capacity. If you think about it, placing a 4.25x multiple on the entire business basically says the entire thing is crappy and dying. It leaves little room for any part of WIN being worth a premium multiple. If the market is indeed aware of WIN’s valuable fiber business, than it is placing a low single-digit multiple on it, which is different than what it’s doing for others. So can someone help me understand how I'm wrong here? What am I missing? How are WIN’s fiber route miles worth a fraction as much as others’? The value, if I’m right about this, is primarily about fiber, not DCs, BTW. As a bit of a cherry on top, WIN mentions in the recent conference call that they own the fifth largest fiber network in the country. I’m not sure if that includes the CSAL miles, but regardless if it does, they control the fifth largest network and the CSAL portion is basically a fixed cost for fifteen years. I looked to find the four larger players and they appear to be: LVLT: 200,000 Comcast: 161,000 CCOI: 86,000 ZAYO: 83,000 WIN: 55,000 The above is probably wrong somewhere, but it is intended to give you an idea of the fiber WIN owns (if not controls).One thing to get started with is the below info sheet about LVLT’s acquisition of TW Telecom, whereby LVLT acquired 34,000 route miles for $7.3 billion. This comes out to $214,000/mile. They also paid 4.5x revenue. It should be noted that my estimate of WIN’s fiber business is approximately this size by revenue and potentially larger on a route mile basis. http://investors.level3.com/files/doc_downloads/Other%20Downloads/LVLT-TWTC_Fact%20Sheet_2014-06-16-2.pdf Here’s telecomramblings.com talking about cost to build fiber these days and some acquisition metrics: http://www.telecomramblings.com/2015/05/industry-spotlight-bank-street-on-last-weeks-fiber-ma-part-1/ 2014 10-K: http://www.sec.gov/Archives/edgar/data/1282266/000128226615000010/a201410k.htm#s0E13EC17E59125B4D7D0A4A56A229EC9