Arski

Member-

Posts

124 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Arski's Achievements

Newbie (1/14)

0

Reputation

-

I find Evolution a really special and great company. Therefore, I wrote a write-up on my blog. Check out below if interested: Evolution (EVO)

-

This, of course, depends on whether the Chinese government is willing to allow BABA, but because the Chinese market is experiencing good secular growth and the country will continue to get more important and expand their power in the world, I think BABA has a reasonable chance of becoming the first $10 trillion company in the world.

-

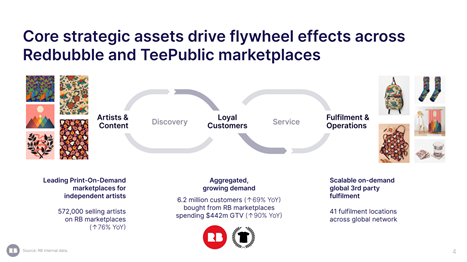

I think this picture says a lot, but not everything. The moat Redbubble has for their print-on-demand marketplace is this flywheel effect (as Etsy and Amazon have with their marketplaces). RBL's moat is not that big yet, but this is getting stronger over time as more customers, artists and fulfilment locations join the platform. Besides that, Redbubble is strengthen its brand, it already has more followers on Pinterest than Etsy has, for example. I think Amazon and Etsy could interrupt RBL at this moment, but I don't think that's going to be the case. For Amazon (and Alibaba), this market is just way to small for now. And when the market becomes big enough for Amazon, RBL would already have such a big platform and, therefore, a big moat (because of the flywheel effect) that Amazon is very likely to lose this battle. The same has happened when Amazon tried to interrupt Etsy's platform and that just didn't work. Etsy could be a bigger problem. I'm not very sure about what I'm going to say now, but as a shareholder of Etsy I believe they are focussing on their platform and building a big brand around it. Starting print-on-demand could interfere with their core marketplace.

-

Yeah, I don't understand the situation completely and I have no faith in their prospects, so I'm out with a 25% loss.

-

Those are interesting names, thanks. It find it difficult to put some names in my coffee can because of the extreme valuation, like SHOP, SE, and NVDA. I know the companies are great but deep down I'm a value investor and will therefore pass. I also like companies that have some earnings already, more than the ones that don't earn. Simply because I'm not able to predict where those earning are going to be over the decade. On the other side, though, that could exactly be the reason one could put a stock without earnings in one's coffee can, if you really believe in the quality of the business over the long-term. I'm also not comfortable with having a meaningful amount of my money in non-productive assets, like BTC and ETH.

-

Others might be: Shake Shack Amazon Fiverr (creator economy)

-

So, I've decided to start a coffee-can portfolio. I'm going to put 20% of my investing money into the portfolio, will spread it across 10 different companies and hope to let it ride for at least 10 years. But I find it quite hard to come up with the companies I'm going to put into the portfolio. I also think it's unwise to select companies that have a big probability of failure and small probability of enormous returns. Some companies that are candidates for me are: Etsy Texas Pacific Land Corp (maybe not at these prices) Alibaba Evolution Gaming JD Let's use this topic for companies that will be alive and thrive over the next ten years.

-

How to generate list of 10 baggers over last decade?

Arski replied to shamelesscloner's topic in Strategies

Very interesting idea. Unfortunately, I have no idea how to get those global 10-baggers. May I ask what you're going to do with those stocks? Study them and look for common traits? -

No problem, hope you liked it!

-

For the people who are interested. I just shared a post about what make CEOs great and how to recognize great CEOs. Link: The Outsiders (wixsite.com)

-

I have written some things down about RBL and I came to the conclusion that the story hasn't changed for them. They will give up profitability to get more revenue growth. Eventually this will result in more growth in EBIT as well. I also forgot that growth and scalability is of real importance to a marketplace and therefore it is very important for Redbubble to be the dominant print-on-demand marketplace. My estimation of the value of Redbubble has come down with a 10% decline, because of the margin contraction, and not as much as the market thinks (23% decline). There's also more certainty that RBL will growth in the future and become a dominant marketplace in the future because of the increased investments. Please tell me if you think I'm wrong

-

Regarding their last earning release and CEO letter: I think it's good that they are going to invest more into the business and try to be a more dominant marketplace. But I become very sceptic when I see the CEO only talking about growth, growth and growth. I am likely to remain shareholder but can't decide yet if I'm willing to add. I have conviction that Redbubble will do well in the future, but maybe the price is still not that compelling. Thoughts?

-

Found the case of Jeremy Raper very interesting: Mo-BRUK (MBRFF): Polish ESG Champion With Long Secular Growth Runway At Value Multiple | Seeking Alpha Only concern is with the Polish government I think. Which is very unpredictable and could have a huge, negative effect. Competitors aren't that big of a concern, at least not within 3-4 years (more information about it in the above write-up of Jeremy). Does someone else see risks that are overlooked?

-

Royalty companies for inflationary period ahead

Arski replied to Arski's topic in General Discussion

Yes, that would be the case. But then, because one dollar is now worth 50 cents, they need to double their earnings to stay even. How do they do that? By doubling their assets, they need a lot of additional capital for that. So, it's economically way more beneficiary to have an asset-light business that needs a lot less capital to double their earnings. Wouldn't operating leverage on rising prices make 2x earnings a low bar when their revenues are also doubling? There might be some flaws in my thinking here. This is what Buffett says in the See's Candies example about doubling revenues: "This would seem to be no great trick: just sell the same number of units at double earlier prices and, assuming profit margins remain unchanged, profits also must double. But, crucially, to bring that about, both businesses probably would have to double their nominal investment in net tangible assets, since that is the kind of economic requirement that inflation usually imposes on businesses, both good and bad. A doubling of dollar sales means correspondingly more dollars must be employed immediately in receivables and inventories. Dollars employed in fixed assets will respond more slowly to inflation, but probably just as surely. And all of this inflation-required investment will produce no improvement in rate of return. The motivation for this investment is the survival of the business, not the prosperity of the owner." I don't know exactly why but he is saying that a business needs to increase their assets in inflationary periods, instead of relying just on increased revenue because of price increases. Maybe someone could help me out and explain why Buffett does not use the concept that when prices increase, revenue will increase and nothing is changed in their inflation-adjusted earnings? Buffett's See's Candy example: “When we purchased See’s in 1972, it will be recalled, it was earning about $2 million on $8 million of net tangible assets. Let us assume that our hypothetical mundane business then had $2 million of earnings also, but needed $18 million in net tangible assets for normal operations. Earning only 11% on required tangible assets, that mundane business would possess little or no economic Goodwill. A business like that, therefore, might well have sold for the value of its net tangible assets, or for $18 million. In contrast, we paid $25 million for See’s, even though it had no more in earnings and less than half as much in "honest-to-God" assets. Could less really have been more, as our purchase price implied? The answer is "yes" – even if both businesses were expected to have flat unit volume – as long as you anticipated, as we did in 1972, a world of continuous inflation. To understand why, imagine the effect that a doubling of the price level would subsequently have on the two businesses. Both would need to double their nominal earnings to $4 million to keep themselves even with inflation. This would seem to be no great trick: just sell the same number of units at double earlier prices and, assuming profit margins remain unchanged, profits also must double. But, crucially, to bring that about, both businesses probably would have to double their nominal investment in net tangible assets, since that is the kind of economic requirement that inflation usually imposes on businesses, both good and bad. A doubling of dollar sales means correspondingly more dollars must be employed immediately in receivables and inventories. Dollars employed in fixed assets will respond more slowly to inflation, but probably just as surely. And all of this inflation-required investment will produce no improvement in rate of return. The motivation for this investment is the survival of the business, not the prosperity of the owner. Remember, however, that See’s had net tangible assets of only $8 million. So it would only have had to commit an additional $8 million to finance the capital needs imposed by inflation. The mundane business, meanwhile, had a burden over twice as large – a need for $18 million of additional capital. After the dust had settled, the mundane business, now earning $4 million annually, might still be worth the value of its tangible assets, or $36 million. That means its owners would have gained only a dollar of nominal value for every new dollar invested. (This is the same dollar-for-dollar result they would have achieved if they had added money to a savings account.) See’s, however, also earning $4 million, might be worth $50 million if valued (as it logically would be) on the same basis as it was at the time of our purchase. So it would have gained $25 million in nominal value while the owners were putting up only $8 million in additional capital – over $3 of nominal value gained for each $1 invested. Remember, even so, that the owners of the See’s kind of business were forced by inflation to ante up $8 million in additional capital just to stay even in real profits. Any unleveraged business that requires some net tangible assets to operate (and almost all do) is hurt by inflation. Businesses needing little in the way of tangible assets simply are hurt the least. And that fact, of course, has been hard for many people to grasp. For years the traditional wisdom – long on tradition, short on wisdom – held that inflation protection was best provided by businesses laden with natural resources, plants and machinery, or other tangible assets ("In Goods We Trust"). It doesn’t work that way. Asset-heavy businesses generally earn low rates of return – rates that often barely provide enough capital to fund the inflationary needs of the existing business, with nothing left over for real growth, for distribution to owners, or for acquisition of new businesses. In contrast, a disproportionate number of the great business fortunes built up during the inflationary years arose from ownership of operations that combined intangibles of lasting value with relatively minor requirements for tangible assets. In such cases earnings have bounded upward in nominal dollars, and these dollars have been largely available for the acquisition of additional businesses. This phenomenon has been particularly evident in the communications business. That business has required little in the way of tangible investment – yet its franchises have endured. During inflation, Goodwill is the gift that keeps giving.” -

Royalty companies for inflationary period ahead

Arski replied to Arski's topic in General Discussion

How do you see a mine expand their operations without making large costs, exactly? I'm just thinking about the difference between an existing mine that might be underproducing, on maintenance and repair, or has adjacent brownfield expansion opportunities vs a mine that has probable reserves that requires building of infrastructure to gain access to the commodity. With commodity price inflation, wouldn't the first mine be better position to capture profit vs the second that requires rapidly inflating capex and thus be less valuable? I think I agree. It would all become clear if calculations are made about the value of mine companies and their mines.