giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

http://seekingalpha.com/article/1531102-an-all-in-bet-on-david-einhorn-greenlight-capital-re?source=email_rt_article_title giofranchi

-

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

http://ir.valeant.com/investor-relations/news-releases/news-release-details/2013/Medicis-Announces-Five-Year-Aesthetic-Collaboration-with-Mentor/default.aspx giofranchi -

Hi Joel, I wouldn’t be so sure… last time that I checked, MKL had substantially larger investments in stocks, as a percentage of equity, than FFH! giofranchi Hi Gio, I think he was not talking about the portion of equity in the portfolio, but instead the float / book value ratio for the company (i.e., that FFH had more float to shareholders equity of FFH than the corresponding ratio at BRK). Yes, I understood what he meant, but I am not so sure I would agree… In a stock market decline, the losses that will hit your capital are only the losses you would incur on the stocks portfolio… the rest of the float is invested in bonds, or something else… am I wrong? So, which equity will shrink more in a stock market decline? FFH’s or MKL’s? I think MKL, because its portfolio of stocks is worth a higher percentage of equity than FFH’s. This of course was before the merger with Alterra. Let’s do some very simple math: FFH: Total portfolio of investments = 30 Equity = 10 Portfolio of stocks = 6 Portfolio of bonds + cash + privately held companies + etc. = 24 MKL: Total portfolio of investments = 20 Equity = 10 Portfolio of stocks = 8 Portfolio of bonds + cash + privately held companies + etc. = 12 Let’s assume a 40% decline in the stock market, and let’s assume their holdings go down with the market. Let’s assume also that bonds + cash + privately held companies + etc. don’t change. The two resulting scenarios would be as follows: FFH: Total portfolio of investments = 27.6 Equity = 7.6 Portfolio of stocks = 3.6 Portfolio of bonds + cash + privately held companies + etc. = 24 MKL: Total portfolio of investments = 16.8 Equity = 6.8 Portfolio of stocks = 4.8 Portfolio of bonds + cash + privately held companies + etc. = 12 Although FFH’s total portfolio of investments is 3 times its equity, while MKL’s total portfolio of investments is only 2 times its equity, the same price decline in stocks would be more detrimental to MKL’s capital than FFH’s: in the MKL case it would decline from 10 to 6.8, in the FFH case, instead, it would decline from 10 to 7.6. This is because MKL’s stock portfolio at the beginning was a higher percentage of its equity than FFH’s: 8 / 10 = 80% in the MKL case, and only 6 / 10 = 60% in the FFH case. If I am wrong, please correct me! giofranchi

-

Sorry to all, if sometimes I seem too “aggressive” in expounding my thesis about FFH… I know criticism and skepticism are very important, and I thank you all for pointing at weaknesses in my reasonings! Anyway, when your thesis is the object of criticism and skepticism, even though you know they will ultimately be very useful, it is not always easy to keep calm, and answer in a relaxed and gentle manner… my fault!! giofranchi

-

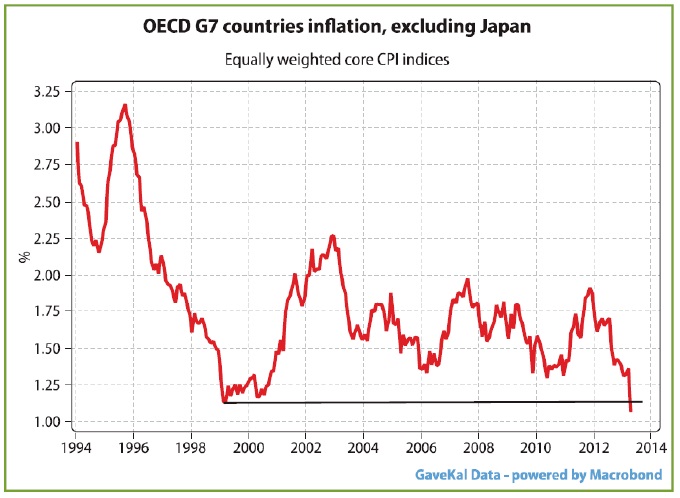

premfan, I don’t think it is that easy… If it were, please explain Japan and Europe! Of course nothing is certain! I just look for something that has the potential to compound capital at 15% annual for a long time, try to understand it as deeply as I can, and then stick with it. That’s all! giofranchi

-

SharperDingaan, I am not sure I have understood what you mean… but I think I have grasped that you don’t believe in an improvement of FFH’s insurance operations. To that I can only say I have great respect for Mr. Barnard and all he has achieved at OdysseyRe, and great faith in what he could achieve overseeing all FFH’s insurance operations. You said annual weather events are getting more frequent, more certain, & more severe… So what? Tell me the rules, and I will make money! Change can only help a great manager like Mr. Barnard, because he will assess it better than other insurers and better than the insured, therefore will be able to benefit from it! Insurance is not going away… and it will always be a relative game: the best managers will make money, all the others will lose money. And Mr. Barnard is among the very best! ;) giofranchi

-

ap1234, I was talking about the BRK of today as an example of what FFH could become tomorrow. You say that FFH will always have a high percentage of assets invested in bonds… Why? Regulatory constraints? Maybe… but I am also convinced that Mr. Watsa and his team will go on seeking the best investment opportunities, available within regulatory constraints! If bonds face serious headwinds in the years ahead, Mr. Watsa and his team will reduce the percentage of bonds in their portfolio of investment as much as possible. Don’t you agree? giofranchi

-

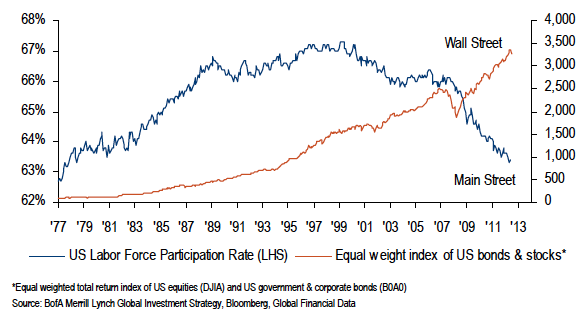

shalab, sorry but I am not sophisticated enough… at page 3 of the file you have previously posted, I have found a 3.2% personal saving rate for May 2013. That’s the figure to compare with the 2.6% in February 2013. And for that figure I have a chart that goes back to 1959. So I can put those numbers in an historical context. Vice versa, I lack a similar chart for the FFA, so a 10% rate is meaningless to me… But, if you could post it, I will be glad to examine which kind of information it really provides. Thank you, giofranchi

-

Packer, I just tried to answer your question why I think the hedges will be resolved one way or the other in a matter of 2 to 3 years. The Central Banks are “all in”, first the US and England in 2009, then Europe in 2011, now Japan in 2013. And when you are “all in”, either you win or you lose, right? I think a 2 to 3 years time will be enough to finally understand if their medicine is the right one. If it is the right one, the markets will probably do more of the same. If it is a wrong medicine, I don’t know what will happen… Sincerely, I think nobody knows… We are ingesting that medicine since the bottom of 2009, so how could anyone know what will happen without it? There is just no evidence! Probably, you are right: a brief shock, soon followed by a fast recovery. For what I know, markets could go on utterly undisturbed! But I also cannot rule out a prolonged slump… That’s why imo the hedges are in place today, and why they probably will become meaningless in a 2 to 3 years time. giofranchi

-

Well, I think it is not just me! Mr. Bernanke’s stated goal is to reduce unemployment, right? And I guess we all agree on the fact that a cost of money that makes no sense has always led to misallocations of capital and bubbles… So, the question is: will the UCBOTW (United Central Banks of The World) succeed in engineering growth and in lowering unemployment with their monetary tools? Or not? If they are successful, I guess they will be able to gradually take the cost of money back to more sensible levels, without any major disruption. I know everybody is worried about interest rate hikes… But I don’t fully agree… In 2009 the UCBOTW saved us… And we have proceeded since then on the assumption they know what they are doing and will ultimately be successful… If they are successful, I don’t see confidence really broken by a rise in interest rates… Sure, there will be adjustments, but nothing dramatic… A more sensible cost of money might even be seen as a positive adjustment! On the other hand, as soon as we lose faith in the UCBOTW, chaos will ensue, no matter how low interest rates are, or how much money will be printed… Imo, it is really as simple as this: if the UCBOTW are successful, FFH’s hedges will prove to be a waste of resources; if, on the contrary, the UCBOTW ultimately fail, FFH’s hedges will prove to be very useful. giofranchi

-

1) I think we should not forget that the hedges, both if proven useful and if otherwise proven a waste of resources, are a matter of 2 more years, 3 at the maximum! If after that they should happen to be still in place, as I have already said, I will be the first to change my view on FFH. 2) At year end 2012 BRK had only 7% of its total assets in bonds. In what probably is going to be a secular bear for bonds, Mr. Watsa will shape FFH to resemble BRK structure more and more. If bonds are no longer an attractive vehicle for investments, Mr. Watsa will choose other asset classes to get a decent return on FFH’s total assets. I want to find someone who is a good strategist, who stays flexible, and doesn’t have too many investing rules. Because too many investing rules and opportunism rarely go along together well. Instead, I want someone who constantly reassesses the situation and takes decisions accordingly. At the same time, I want to see a basic “philosophy”, that provides the solid bedrock on which everything else will be built. Opportunism and Value are a philosophy, not rules. Both Mr. Watsa and Mr. Marks fit my idea of great business partners. And, as strange as it might sound, I am positive they both will ultimately do very fine, even if today they have different views and have structured very different portfolios of investments. giofranchi

-

giofranchi

-

tombgrt, probably, I didn’t express myself well enough… My idea is basically that it will take only a 7.5% annual return from their portfolio of investments, for FFH to increase BVPS at a CAGR of 15%. Given that, contrary to what happened during the last decade, I expect insurance operations to get better and better, and finally to achieve an underwriting profit, the annual return needed from their portfolio of investments might actually be only around 7%. Historically, instead, they have achieved a 9.4% annual return. If they perform 25.5% worse than they did in the past, buying at book today will assure you a 15% compounded return on your investment. To say they returned just 9% during the last 10 years clearly doesn’t make sense… it is enough to read Mr. Watsa’s 2012 AL to understand it very clearly… They thought they should be particularly careful with their portfolio of investments during the last 10 years, and probably during the next 5 years, and therefore they embarked FFH on a “defensive – aggressive – defensive again – aggressive again trip”. In 2003 – 2006: defensive, in 2007 – 2009: aggressive, in 2010 – 2013: defensive again… Well, but it should be evident to everyone it is an unfinished trip!! To judge their future possible performance, based on the last 10 years, makes no sense to me. As far as trading is concerned, to jump in and out FFH, it might be a good idea… But I don’t do that. I have two businesses to look for each single day, and don’t have the time to get comfortable with trading. As Mr. Harriman said: And I stick with it. Packer, I love Mr. Keynes and I think he has been one of the great minds of last century. And I love the way he invested his capital. Anyway, as you can see from the file in attachment, his net worth in 1936 was £506.522, while in 1945 is was just £411.238, after declining to as low as £171.090 in 1940… think of it: in just 4 years he saw his net worth declining –66.2%… According to maynardkeynes.org, also the Chest Fund suffered a –40.1% decline in 1938, then again a –15.6% in 1940, for a cumulative decline of –43% from 1937 to 1940… Sorry, but I cannot conceive investing like the world were always the same… Studying all the great “wealth accumulators” of the past, they have one thing in common: they knew when to be aggressive, and when to be defensive… ah! And, of course, they were also right! WEB, and, if you look at BRK’s balance sheet, at the end of 2012 they had 18% of Total Assets (or 41% of Equity) in Cash + Bonds, with $1.2 billion of free cash coming in every month. BRK will never suffer from a lack of cash: we better make sure we will neither! Shalab, My source of information is The Gary Shilling Insight, whose source in turn is The Bureau Of Economic Analysis. Its last point was Feb.2013 and it was 2.6%. If in the meantime it has gone up to 3.2%, it is good news. But, please consider that it is a very volatile figure, so a +0.3% in April followed by a +0.4% in May might not make a positive trend yet… PlanMaestro, You surely know better than that! When there is too much debt, everyone is on the hook. No one is spared. Too much debt basically means two things: 1) too much capital chasing too few ideas, huge misallocations of capital and bubbles follow; 2) capital spent recklessly to live beyond our means. In either case capital will be destroyed. It follows that both borrowers and lenders will suffer almost the same. And for good reasons! Because lenders behaved foolishly and acted imprudently. Now they won’t have their money back. So, it really doesn’t matter who is the lender and who is the borrower. Once there is too much debt, compared to the net worth or to the income capability of an individual, a family, a business, a nation, or the world, 1) and 2) will make sure borrowers and lenders will suffer alike. giofranchi John_Maynard_Keynes_Part2-October_2010.pdf

-

Packer, maybe it is just me that don’t get it right… but I really don’t understand how it is possible to say there is no high leverage today… Just look at the balance sheet of Deutsche Bank (see the file in attachment)! The whole world is over indebted, even China! Where corporate debt alone is almost 200% of GDP! Do you think Japan is sustainable? Then I really don’t know what sustainable means! And southern Europe?! Can you imagine what it means for a nation, like Italy for instance, to live without a currency that makes economic sense? As long as policy makers don’t admit it, the Euro will continue to be a major distortion and will continue to cause dangerous misallocations of capital. And, if you don’t like GDP, what about personal incomes in the US, which have gone back to the ‘80s level? And the personal saving rate?! At little more than 2% it is way too low, and cannot be reconciled with a nation on its way to create true and lasting wealth. In the ‘30s also, the personal saving rate fluctuated in between 0% and 5%, until it spiked to 25%… and that was what ended the depression! A renewed culture of thriftiness and accumulation of wealth on a nationwide scale. Now think about what will happen to net margins, when the personal saving rate will get back to, let’s say, 10% from 2.4% today… Yet, the stock market is at its all time high… But don’t you dare hinting at the fact the economy might be slowly improving, like Mr. Bernanke so naively did a few days ago, because that will trigger chaos… C’mon… Isn’t that ridiculous?! In the last century wars have only been the consequences of dealing with the social unrest, that sprang from misconceived economic policies. They were not the true causes. Maybe, we will find other means to deal with our own over indebtedness, not necessary new wars… at least by their classic definition, but why do you assume those new means will be painless? I don’t see any reason why they should be! giofranchi Deutsche-Bank-Horribly-Undercapitalized.pdf

-

Well, as I have said a few posts ago, last decade economic growth has been the second slowest after the ‘30s in American history (1.7% y-o-y vs. 1.4% y-o-y… sorry, cannot see all that difference!), despite monetary stimulus has been the most extreme in American history, much larger than what had ever been attempted even from 1933 to 1937 by the Roosevelt administration! You must at least admit that the jury is still out… To reflate bubbles, after they have burst, is not synonymous with prosperity, it is just prosperity in disguise! But I guess in a couple of years we will have the final verdict, as “the great disconnect” of Mr. Shilling, will finally be resolved, one way or the other! Until that time, whoever reaches for yield imo is not right, but just reckless and, if finally proven right, lucky. I repeat: FFH has made no major strategic blunder that I know of till now. They are great strategic thinkers and I would have done exactly the same. No, wait, actually I have done exactly the same! If in a two years time the real economy finally does what policy-makers wish it for, then I would like to see FFH stop its hedging strategy. Vive versa, if it keeps going on even then, I will admit they are making their first serious mistake, and I will reformulate my thesis on FFH. But then, anyhow, a lot of things will be very different… think of how wonderful it would be: we will have finally find the way to live beyond our means for decades and getting away without paying the consequences! A brand new fantastic world! Hmmm… I don’t think so! giofranchi

-

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

Morningstar assigns a 5 stars rating to VRX (see file in attachment) + "Bausch&Lomb Purchase Highlights Value-Creation Ability of Valeant's Moat". giofranchi VRX-Morningstar.pdf BauschLomb_Purchase_Highlights_Value-Creation_Ability_of_Valeants_Moat.pdf -

Well, I guess any comparison with the past might only take you that far, right? What is really needed in investing is a strong conviction about future possible returns. There is really no substitute for due diligence and all the hours spent studying and trying to deeply comprehend a business. :) giofranchi After doing your DD, what would you say are the possibilities for FFH? Other than Prem's track record of course. In the past, BV growth was helped by an amazing bull market in bonds, extraordinary CDS gains, the first years (? first year 180% BV growth if I remember correctly) of operations, ... I'm just curious because just a few posts ago you said this: The case for Berkshire is actually very simple (even after WEB is gone) with it's decentralized group of very high ROE companies, great insurance companies underwriting at a great CR and long-term equity investments. It's likely that it remains a stable powerhouse with satisfactory returns. Considering that you said yourself that there is no alternative to doing your DD; why do you view Fairfax as more attractive? For FFH I see a very safe 15% CAGR in BVPS for the next 10 to 15 years. To know and accept what I still don’t understand, and therefore cannot judge, and therefore cannot put a valuation to, is imo an integral part of DD. I repeat what I said a few posts ago: I just don’t understand a business on autopilot. But I am sure everybody else will do just fine with BRK! :) giofranchi

-

Comstock Partners, Inc. - Market Facing Severe Headwinds giofranchi Market_Facing_Severe_Headwinds.pdf

-

Well, I guess any comparison with the past might only take you that far, right? What is really needed in investing is a strong conviction about future possible returns. There is really no substitute for due diligence and all the hours spent studying and trying to deeply comprehend a business. :) giofranchi