giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

David, thank you very much for posting Mr. Mark Grant's thoughts! :) giofranchi

-

Hi hyten, the fact imo is not there are people who live with a debt burden 3 times their yearly income and who save and invest just 2% of their yearly income. Of course there are! It simply is the average of the world we are living in! Given that you and I have no debt and save and invest 20% of our yearly income, it automatically follows that there must be some people who live with a debt burden HEAVIER that 3 times their yearly income and who save EVEN LESS than 2% of their yearly income! Right? The fact is: do you know people like that, who are also successful in building lasting wealth? Personally, not only I don’t know any, I wouldn’t even know how to increase my net worth, or the net worth of my firm, if I had to be burdened with such an high debt, or if I had to save and invest so little. Now, how can a nation of individuals, who stay poor, get richer?! I am surely a macro tourist… But you don’t need macro… You only need to go back to old Ben Franklin… reread his Poor Richard and his Autobiography… Imo, what a person, a family, a company, or a nation need to build lasting wealth is all in there. --Benjamin Franklin Now, what are the investing implications? I think that you must stay flexible. If you study any great investor and entrepreneur of the past, not one excluded that I know of, they never aimed for a 15% return every year, year after year. Instead, they all understood that to get a 15% average annual return, they had sometimes to be careful, and be content with a 7%-10% return, and sometimes to be aggressive, and shoot for a 20%-25% return. All of them grew moderately when times were good and opportunities were few, and grew by leaps and bounds when times were hard and opportunities were plentiful. Don’t ask me how: it is up to you! But I think we won’t regret to have learnt from them and tried to follow their example. :) giofranchi

-

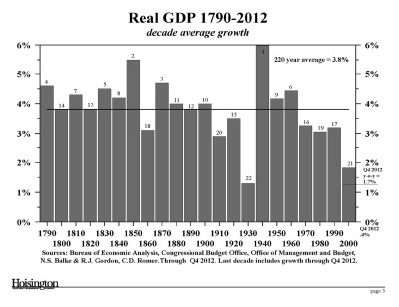

PlanMaestro, I don’t think you are being fair with Mr. Kyle Bass… Anyway, if you didn’t like his presentation, please watch Mr. Lacy Hunt’s and Mr. Charles Gave’s presentations. And look at the picture in attachment: clearly, we have got a problem. How we can go on denying it is beyond me… And the problem is fairly simple, but extremely difficult to admit, because, if you admit it, you must also acknowledge there is no easy way out… Let me ask you a question: have you ever tried to live with a debt burden that is 3 times your yearly income? If the answer is yes, let me ask you another question: have you ever saved, and invested in productive enterprises, just 2% of your yearly income? If the answer is yes again, let me ask you a third question: have you ever experienced those two miserable states of being together? Put them together and no one will be able to grow wealth: not a person, not a family, not a company, not a nation. Unfortunately, there is no getting around this. And sooner or later you must bring down your debt and increase your savings and investments. You might be able to buy some time, the way Mr. Keynes has thought us, but ultimately a successful person, a successful family, a successful company, and a successful nation know how to live within their means and invest for the future. And once those things have been forgotten, sooner or later you must endure the pain of relearning… giofranchi

-

Part III giofranchi Stock-Market_Crashes_Through_the_Ages-PartIII-Early-20th-Century.pdf

-

Cheers! giofranchi Mayer-ValueInvestingCongress-050613.pdf

-

Mr. Charles Gave on The Problem With Leading Indicators. giofranchi Daily+6.17.13.pdf

-

Dan Loeb's 2nd Letter to Sony, Pushing For Spin-Off Again http://blogs.wsj.com:80/moneybeat/2013/06/17/loebs-letter-sony-entertainment-lacks-discipline-accountability/ giofranchi

-

Yes! Of course, I also watched Mr. Lacy Hunt's presentation: a great scholar in the history of finance, teacher, and money manager! Fantastic speech! :) giofranchi

-

-

Very nice plug for the Peter Cundill There's Always Something to Do book. I agree that it was a great book. I enjoyed that book too, very much! And thank you for posting the presentation: very informative indeed! :) giofranchi

-

Hi David! I have just finished watching Mr. Charles Gave's presentation at the SIC, and I have found it extremely interesting! http://www.altegris.com/7bc4a10061b00c4200bb5b769405e45c78.aspx?nr=1#bass2 Cheers! giofranchi

-

Mr. Gundlach: Don't Sell Your Bonds. giofranchi Gundlach-Dont_Sell_Your_Bonds.pdf TR-Core_Webcast_Slides.pdf

-

http://seekingalpha.com/article/1503352-brookfield-property-partners-has-meaningful-upside-potential?source=email_investing_ideas&ifp=0 giofranchi

-

http://seekingalpha.com/article/1504432-liberty-media-is-sirius-about-time-warner?source=email_rt_article_title giofranchi

-

Deutsche Bank "Is Horribly Undercapitalized... It's Ridiculous" Says Former Fed President Hoenig. giofranchi Deutsche-Bank-Horribly-Undercapitalized.pdf

-

Stock Market Crashes Through the Ages: Part I & II. giofranchi Stock-Market-Crashes-Through-the-Ages-Part1-17th-and-18th-Centuries.pdf Stock-Market-Crashes-Through-the-Ages-PartII-19thCentury.pdf

-

-

-

Very good piece by Mr. David Hay. giofranchi EVA+6.14.2013+NA+b.pdf

-

http://www.oldschoolvalue.com/blog/ideas/dan-loeb-stock-picks/ http://www.bloomberg.com/news/2013-06-10/sony-holdings-blurred-by-third-point-swaps-goldman-bonds.html giofranchi

-

anders, I don’t know if it was offensive… I think we should ask Phaceliacapital… to me it sounded like he were compared to the legendary shoeshine boy, who gave stock tips to Mr. Baruch in 1929… and I guess I wouldn’t enjoy the comparison, if it were directed to me… More important, I don’t think the comparison is due at all: Phaceliacapital recognized he lacks knowledge about high yield, junk, distressed debt opportunities, and asked for help to people who he thinks might be more knowledgeable than he is. To me that is as far from the shoeshine boy as it could be. Phaceliacapital seems to know when he is venturing outside his “circle of competence”, and this alone imo will keep him out of trouble. And, if you know how to avoid trouble, you are among the best investors out there. :) giofranchi

-

Those are good questions. And the fact LUK lacks the luxury of having free insurance float to invest is a valid point. As twacowfca’s remark that Cumming & Steinberg will be tough to equal is also certainly true (I would add not only in straight shooting communication with shareholders…). Simply put, I still ignore the answers, or I don’t feel comfortable enough with them yet. Both Mr. Handler and Mr. Wheeler are young and there will be plenty of time to watch them carefully and to get more confident with the new management, both their strengths and weaknesses. giofranchi Giofranchi. As I have told you before I really respect your thinking. I own LUK and have for a while. In fact it is one of my larger positions. I trusted Cumming & Steinberg with investing my money and was very confident in their acumen. Just like my belief in Buffett, & Watsa I just can't see them just haphazardly turning over their portraits without being VERY confident in their successor choices. I also suspect that they are still very in tune with the continuing brush strokes being made. Ron I agree. The jury is still out, but the extradinordinary action of turning over the keys to Handler is inconsistent with any other sensible hypothesis than the idea that Steinberg and Cumming hold a firm conviction, based on close observation, that Handler is as good a value investor, holding the same values, as they are. :) Ron and twacowfca, yours is good reasoning indeed. No doubt about it! Anyway, I think conviction about a business is something not entirely rational… I might be very well wrong about this, but let me ask you a question: if we agree on all the facts and numbers, do you think that it automatically entails we share the same degree of conviction about a business? Though I am an engineer and I tend to rely heavily on facts and numbers, I have gradually come to the conclusion that the right answer is: not necessarily. And yet, think of how easily you can buy and sell a business today… just a few clicks on your mouse are required… And that’s the reason why you MUST have conviction! Because, otherwise, you are going to commit errors. Imo, no one who lacks conviction will be spared! That’s exactly why I “feel” I need to watch Mr. Handler and Mr. Wheeler a little bit longer, to get back to the same degree of conviction I had when Mr. Cumming and Mr. Steinberg were at the helm. At the same time I understand that your “feeling”, and therefore your behavior and investment choices, might be different. I respect them. :) giofranchi

-

anders, I don’t want to be offensive, but I simply don’t agree. Like Parsad has pointed out, on this board you are in the company of at least a couple dozen people who have achieved results during the last 10 years that have handily beaten 99.99% of investment managers in the world. And I would be very glad to hear from them on any subject, in any part of the market cycle! I might agree high yield bonds are to be shunned at these prices, but to build knowledge is always a worthwhile endeavor. And this board is a wonderful school, in which you could always learn a lot! ;) giofranchi

-

http://www.gurufocus.com/news/221438/carl-icahns-newest-beneficiary giofranchi

-

Those are good questions. And the fact LUK lacks the luxury of having free insurance float to invest is a valid point. As twacowfca’s remark that Cumming & Steinberg will be tough to equal is also certainly true (I would add not only in straight shooting communication with shareholders…). Simply put, I still ignore the answers, or I don’t feel comfortable enough with them yet. Both Mr. Handler and Mr. Wheeler are young and there will be plenty of time to watch them carefully and to get more confident with the new management, both their strengths and weaknesses. giofranchi