giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Greg, I was asking about stock market investment returns during the nine years from 2000 to 2008. By the way BH stock market investment returns have trounced the S&P500 from 2009 to 2014, which is something very few hedge fund managers have achieved! ;) Cheers, Gio

-

By the way, I guess your numbers are backed by the assumption that 20 years from now FIH will be selling at NAV, right? Well… something that has grown NAV at 12% for 20 years?! Using a discount rate of 9%, it would be worth 1.72xNAV; using a discount rate of 10%, it would be worth 1.43xNAV. Gio

-

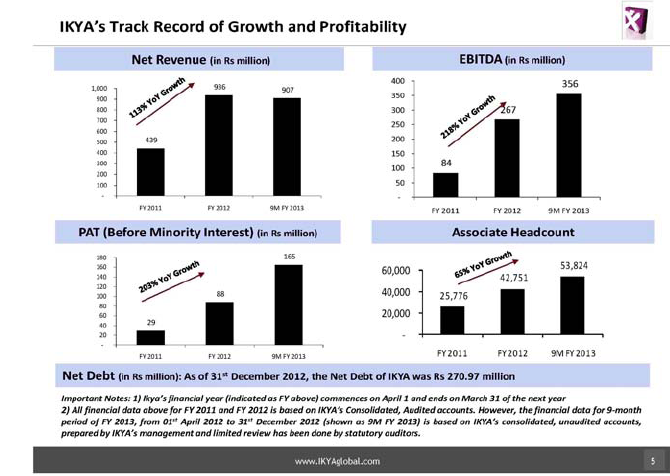

No, I was not. Instead, I ask you: have you seen the numbers posted by IKYA? Gio

-

Sanjeev, I am not fond of Biglari… I only like two things in this world, and Biglari certainly is not among them… Instead they are: girls and business results! ;D ;D As for business results, I have asked in this thread before: 1) Show me a money manager who did better than a CAGR of 13.6% during the 9 years from 2000 to 2008… No one has answered… 2) Show me another restaurant chain which has increased same store sales for 25 quarters in a row… Again no one has answered… As for girls, I am coming with Laura at the Fairfax dinner in a few days (if she doesn’t dump me in the meantime! ;D ;D), and I will be glad to introduce her to you! ;) Cheers, Gio

-

philly value, I think the best answer to what you are saying is provided by Biglari himself in his 2012 AL: (emphasis mine) And don’t think for a minute this approach is not repeatable! It is a very entrepreneurial way of investing and one Biglari has used with great success many times in the past. NBL, the fact I stress what I like about BH doesn’t mean BH is an “Everything is awesome” situation to me… Instead, it is just a consequence of the fact so many people on this board stress what they don’t like about BH! A voice out of the pack is always needed! ;) Cheers, Gio

-

Someone who would return the capital to shareholders instead of himself? Joel, Generally when I find someone who asks to be paid less than average for business results that are much better than average, I don't complain... I just say thank you and hope the overperformance goes on for the longest time possible... But... Of course there is Buffett who doesn't ask to be paid... In my experience the great majority of people, who work and don't ask to be paid, are charlatans (with few exception like Buffett, of course!) ;) Cheers, Gio

-

NBL, A "more credible" activist should be an "effective" activist... An effective activist is an investor who finds and pushes for a way to get better business results... 25 straight quarters of same store sales growth... Investment returns that beat 99% of hedge fund managers (just because I could never be sure of saying 100%!!)... Who on earth would ever promise to achieve better results for BH shareholders?!?! Cheers, Gio

-

Of course, I cannot know if this is ever going to happen… But to put together Brindle’s underwriting abilities and Oaktree’s skills in investing, especially in fixed income securities, strikes me as a brilliant idea! ;) Cheers, Gio

-

Marks partners with Brindle. Gio

-

To suggest withholding votes is never very intelligent. What if everyone follows their advice?! ::) Cheers, Gio

-

Well, that clearly depends on the rate of growth we are expecting for the next several years. Take a look at IKYA’s rate of growth in attachment. Do you think FIH could be able to find just one business per year for the next 5 years, which could grow like IKYA? (or almost?) If the answer is yes, I think 2 x NAV could still turn out to be a worthwhile investment! ;) Cheers, Gio

-

Gio

-

??? Ok… I had missed that until now… Is Gabelli truly going to vote in favor of Groveland?!… If so, when has he announced his decision? Thank you, Gio

-

In theory I agree… In practice I don’t… In practice I am satisfied valuing what I get for what I give away, and make sure it is worthwhile. Another thing I do is to check there are no cheaper alternatives: of course FFH is cheaper than BH, and that’s why my investment in FFH is much larger than the one I have in BH. Cheers, Gio

-

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

I would say he is just pissed off about the relocation of Valeant to Canada for tax reasons… Something Berkshire could never do… ;) Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

I agree 100%! And that’s exactly why I am happy to be a VRX’s shareholder again, and why today I am buying more! :) Business results! The only thing that matters to me: 1) One year ago it was not easy at all to understand the true performance of acquired and restructured businesses… today, instead, it is much clearer! 2) As a consequence, one year ago there was no clear evidence about organic growth… today, instead, they have largely demonstrated they will grow organically too! 3) One year ago there was no evidence they had their debt level under control… today, though debt remains the only concern I still have about VRX, they have demonstrated they are able to reduce debt quickly if they want or in case of need! 4) One year ago the gap between Cash EPS and GAAP EPS was attacked by the shorts… today, instead, they have demonstrated that just a few months without new acquisitions are enough to make Cash EPS and GAAP EPS converge! Imo very clear and convincing business results. Cheers, Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

Well… Valeant size and reputation have never been concerns of mine… Good idea! :) Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

+1 I think my actions speak louder than words: when I wasn’t able to answer all the doubts that were raised about VRX’s business model in 2014 by myself, and needed the company to show all those criticisms were wrong, I sold out. Now I am a VRX shareholder again, not because I am a “fanboy”, but because I believe the company has proven all those criticisms wrong. Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

“fanboys”… are usually people who don’t care about rational things… and who don’t look for great results… I hope it is not me! ;) Gio -

Dazel, you very well know how much I respect your thoughts and point of view. For all the respect I have, I must say I think you are right about ALS, but wrong about BH. Cheers, Gio

-

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

At this point in time…?! ??? I take the exact opposite view. Like I have already said, this is precisely the time I feel the most comfortable with VRX’s business model (its high level of debt excluded…): if you are not comfortable with VRX's business model after all the attacks in 2014, and how successfully VRX has responded, you will never get comfortable with it! Nothing wrong with that, of course. ;) Cheers, Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

Yes! Of course! :) Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

http://www.marketfolly.com/2015/03/pershing-square-reveals-size-of-valeant.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+MarketFolly+%28Market+Folly%29 Gio -

VRX - Valeant Pharmaceuticals International Inc.

giofranchi replied to giofranchi's topic in Investment Ideas

I would say I have no hero… All I care about are rational things, instead of irrational things… All I look for are great results, instead of poor results… Whoever acts rationally and gets great results… Well, he/she is my "hero"… Until he/she starts acting irrationally and getting poor results! ;) Period. Cheers, Gio -

Howard Mark's new memo: Liquidity Cheers, Gio Liquidity.pdf